What You Need to Know About the Updated FLSA in 2025

What You Need to Know About the Updated Fair Labor Standards Act in 2025 covers critical changes impacting minimum wage, overtime pay, and worker classifications. Understanding these updates is essential for employers to ensure compliance and for employees to protect their rights.

The Fair Labor Standards Act (FLSA) is a cornerstone of US labor law, setting standards for minimum wage, overtime pay, recordkeeping, and child labor. As we look ahead, understanding what you need to know about the updated Fair Labor Standards Act in 2025 is crucial for both employers and employees.

Staying informed about potential changes ensures businesses can maintain compliance and workers can advocate for their rights. Let’s delve into the key areas that may see updates and what these could mean for you.

What You Need to Know About the Updated Fair Labor Standards Act in 2025: An Overview

The FLSA, enacted in 1938, has been amended numerous times to adapt to the evolving needs of the workforce. As we approach 2025, it’s important to anticipate further updates that could affect various aspects of employment. What you need to know about the updated Fair Labor Standards Act in 2025 includes understanding potential changes to minimum wage, overtime regulations, and worker classification standards.

Minimum Wage Adjustments

One of the most closely watched aspects of the FLSA is the federal minimum wage. While some states and cities have already implemented higher minimum wages, the federal rate remains a key benchmark. Anticipate discussions around increasing the federal minimum wage in 2025, possibly to $15 per hour. Such an increase would have significant implications for low-wage workers and businesses across the nation.

- Impact on Businesses: Businesses, especially small ones, may need to adjust their financial planning to accommodate higher labor costs.

- Impact on Workers: A higher minimum wage can improve the living standards of low-wage workers, reducing income inequality.

- State and Local Variations: Keep an eye on state and local minimum wage laws, as they may exceed the federal rate.

Understanding the potential adjustments to minimum wage is a critical part of what you need to know about the updated Fair Labor Standards Act in 2025.

Overtime Pay: Understanding Potential Changes

Overtime pay is another crucial component of the FLSA. It typically requires employers to pay employees 1.5 times their regular rate of pay for hours worked over 40 in a workweek. Changes to overtime regulations can affect a wide range of workers and industries.

Updates to Overtime Eligibility

One area that often sees updates is the threshold for overtime eligibility. The FLSA includes exemptions for certain employees, such as those in executive, administrative, and professional roles. The salary threshold that determines whether these employees are eligible for overtime can change. It’s crucial to stay informed about any potential adjustments to this threshold as part of what you need to know about the updated Fair Labor Standards Act in 2025.

- Salary Threshold: The salary threshold determines which white-collar workers are eligible for overtime pay.

- Duties Test: Employees must also meet certain duties tests to qualify for exemptions.

- Industry-Specific Rules: Some industries have specific overtime rules, so it’s important to know the regulations that apply to your particular sector.

Staying updated on overtime pay regulations is essential for employers to ensure compliance and for employees to understand their rights.

Worker Classification: Employee vs. Independent Contractor

The distinction between employees and independent contractors is a significant aspect of labor law, and it is often subject to scrutiny and updates. Misclassifying workers can lead to serious legal and financial consequences for employers. To understand what you need to know about the updated Fair Labor Standards Act in 2025, pay close attention to the evolving standards for worker classification.

The Impact of the Gig Economy

The rise of the gig economy has made worker classification even more complex. Many gig workers are classified as independent contractors, but there have been ongoing debates and legal challenges regarding this classification. Courts and regulatory agencies often consider factors such as the degree of control the employer has over the worker, the worker’s opportunity for profit or loss, and the permanence of the relationship.

- Control Over Work: Employers who exert significant control over how a worker performs their job are more likely to be considered employers.

- Opportunity for Profit or Loss: Independent contractors typically have more opportunity for profit or loss than employees.

- Permanence of Relationship: A long-term, ongoing relationship is more indicative of an employer-employee relationship.

Proper worker classification is crucial for compliance with the FLSA and other labor laws. Employers should regularly review their classification practices to ensure accuracy.

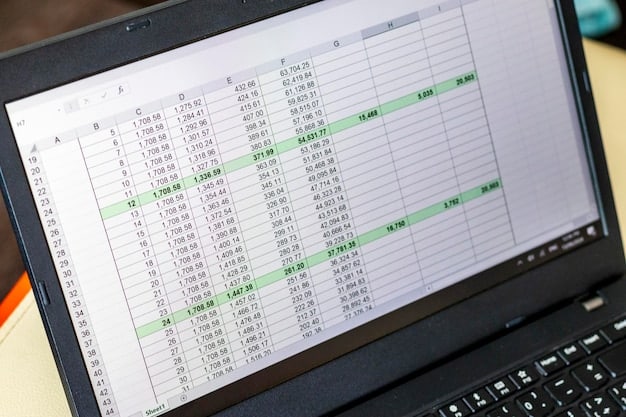

Recordkeeping Requirements: Ensuring Compliance

Accurate and thorough recordkeeping is a fundamental requirement of the FLSA. Employers must maintain detailed records of hours worked, wages paid, and other relevant information. These records are essential for demonstrating compliance with minimum wage and overtime regulations. As part of what you need to know about the updated Fair Labor Standards Act in 2025, understand that maintaining proper records is not just advisable; it’s legally mandated.

Technological Advancements in Recordkeeping

With technological advancements, many employers are now using digital systems to track employee hours and wages. These systems can streamline recordkeeping and improve accuracy. However, it’s important to ensure that these systems comply with all FLSA requirements. Remember, what you need to know about the updated Fair Labor Standards Act in 2025 includes keeping these records accessible and secure.

- Accuracy: Ensure records accurately reflect hours worked and wages paid.

- Accessibility: Records should be easily accessible for review by employees and regulatory agencies.

- Retention: Maintain records for the required retention period, typically three years.

Adhering to recordkeeping requirements is crucial for avoiding penalties and legal issues related to the FLSA.

Child Labor Laws: Protecting Young Workers

The FLSA also includes provisions to protect young workers from hazardous or exploitative labor practices. Child labor laws restrict the types of jobs that minors can perform and the hours they can work. These regulations are designed to ensure that young people can balance work with their education and development. As part of what you need to know about the updated Fair Labor Standards Act in 2025, be aware of these protections and potential updates to them.

Potential Updates to Regulations

Child labor laws are periodically reviewed and updated to address emerging issues and ensure the safety and well-being of young workers. These updates may include changes to the types of jobs that are permissible for minors or adjustments to the hours they can work. Keeping abreast of these changes is an important aspect of what you need to know about the updated Fair Labor Standards Act in 2025.

- Permissible Jobs: Certain jobs are deemed too hazardous for minors and are prohibited.

- Hours Restrictions: There are limits on the number of hours minors can work, especially during the school year.

- Age Verification: Employers must verify the age of young workers to ensure compliance with child labor laws.

Compliance with child labor laws is essential for protecting young workers and avoiding legal penalties.

Enforcement and Penalties: Staying Compliant

The FLSA is enforced by the US Department of Labor (DOL). The DOL has the authority to investigate potential violations, conduct audits, and impose penalties for non-compliance. These penalties can include back wages, fines, and even criminal charges in some cases.

To ensure you fully grasp what you need to know about the updated Fair Labor Standards Act in 2025, understand also the consequences of non-compliance.

How to Avoid Penalties

Staying compliant with the FLSA requires a proactive approach. Employers should regularly review their employment practices, maintain accurate records, and seek legal advice when necessary. It’s also helpful to stay informed about DOL guidance and enforcement trends.

- Regular Audits: Conduct internal audits to identify and correct any potential compliance issues.

- Employee Training: Train managers and supervisors on FLSA requirements.

- Legal Advice: Consult with an attorney specializing in labor law to ensure compliance.

Staying informed and taking proactive steps can help employers avoid costly penalties and legal issues related to the FLSA.

| Key Area | Brief Description |

|---|---|

| 💰 Minimum Wage | Potential increase to the federal minimum wage, impacting low-wage workers and businesses. |

| overtime Overtime Pay | Possible changes to the salary threshold for overtime eligibility. |

| 🧑💼 Worker Classification | Standards for classifying workers as employees versus independent contractors. |

| 📝 Recordkeeping | Requirements for accurate and accessible records. |

FAQ

The FLSA covers minimum wage, overtime pay, recordkeeping, and child labor standards, aimed at protecting workers’ rights and ensuring fair labor practices across various industries.

The FLSA is updated periodically through amendments and regulatory changes to adapt to evolving economic conditions and workforce needs, addressing issues as they arise.

The federal minimum wage may see an increase, potentially to $15 per hour. Businesses should be prepared for adjustments, and workers should be aware of their rights to fair compensation.

Accurate recordkeeping is crucial for demonstrating compliance with minimum wage and overtime regulations. Maintaining detailed records helps avoid penalties and legal issues related to the FLSA.

Worker classification standards are continuously evolving, particularly with the rise of the gig economy. Accurate classification, whether employee or independent contractor, is essential for compliance and avoiding legal repercussions.

Conclusion

Understanding what you need to know about the updated Fair Labor Standards Act in 2025 is essential for both employers and employees. By staying informed about potential changes to minimum wage, overtime regulations, worker classification, and recordkeeping requirements, you can ensure compliance and protect your rights.

Proactive measures, such as regular audits and employee training, can help you navigate the complexities of the FLSA and avoid costly penalties. Keeping abreast of DOL guidance and seeking legal advice when necessary are also valuable strategies for maintaining compliance and fostering a fair and equitable workplace.